The latest mutual full family members income (earnings prior to write-offs) should determine qualifications to own Canada Student loans and Canada Pupil Gives

- April 17, 2022

- Colorado_Littleton payday loans

- Posted by admin

- Leave your thoughts

When you’re a citizen away from Newfoundland and you may Labrador, you may be eligible to found financial help when you find yourself training area-date in the a selected blog post-additional institution.

How to Use

To apply for region-time funding, would a beneficial StudentAidNL membership or indication into your newest account to help you complete and you will fill in the application.

Because of the finishing the fresh new part-go out app and you can entry all needed models and you may documentation, StudentAidNL commonly evaluate your application to own federal and you can provincial financial help.

- System Cost Means (Part-Time)

- Spouse’s/Common-Laws Partner’s Statement, Concur and Trademark Mode (Part-Time),when the appropriate

- Backup of the 2020 Taxation Observe off Comparison having evidence of income (2019 having 2020-21 application)

- Backup of your Mate/Common-Laws Partner’s 2020 (2019 for 2020-21 application) Income tax See from Research to have proof money (when the relevant)

Note: College students using because the a student which have a long-term disability need certainly to complete the brand new Confirmation of Qualification Function unless of course he has got in past times recorded it form and you will StudentAidNL features recognized the position because the a student which have a long-term impairment. Children demanding finance to possess knowledge-associated characteristics and you will gadgets expenses associated with the new handicap must done the applying to have Functions and you will Gadgets for students which have Long lasting Disabilities.

Eligibility

- You are a good Canadian resident (because the defined in the Citizenship Act), long lasting resident or keeps protected people (because defined on Immigration and you may Refugee Safety https://getbadcreditloan.com/payday-loans-co/littleton/ Act), otherwise a guy inserted since an Indian (underneath the Indian Work)

- Youre a resident regarding Newfoundland and you will Labrador

- You’ve got a valid Canadian Personal Insurance policies Number

- You’ve got presented economic you want

- You violation a credit check (simply for very first time people twenty-two yrs . old otherwise earlier)

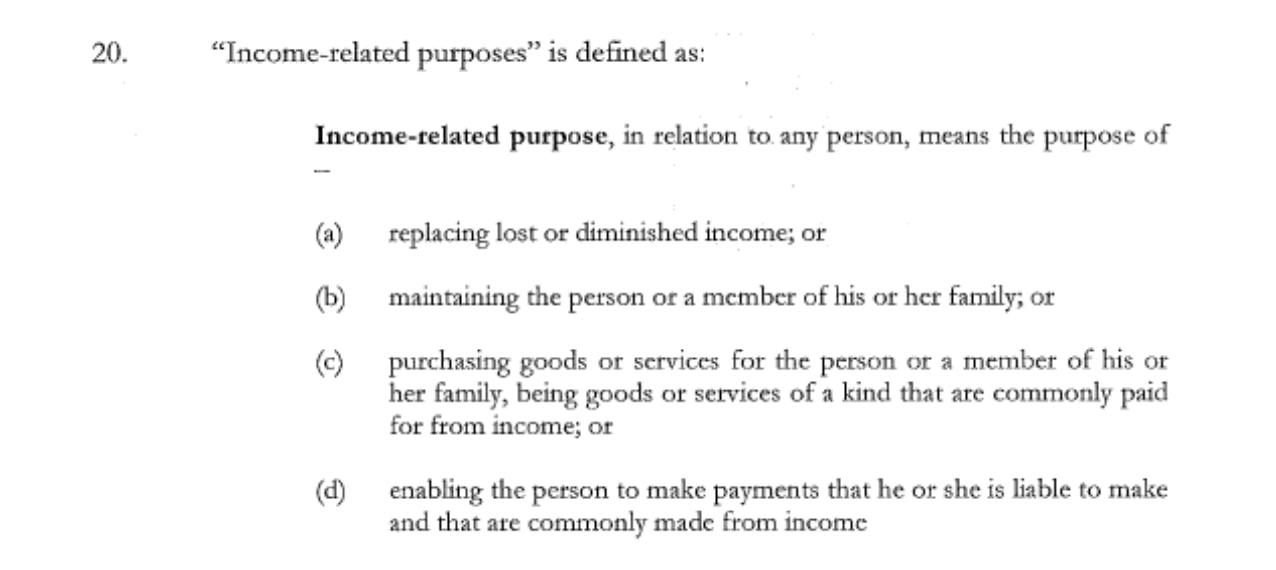

Course Weight Standards

The new blog post-secondary educational business identifies the student’s movement load fee predicated on what number of courses students are bringing than the basic quantity of programmes into the system from investigation. Federal funds and you will features together with provincial gives come to people partly-date studies delivering anywhere between 20% and you may 59% regarding the full direction load.

Note: Eligible pupils that have long lasting handicaps enrolled in forty% to help you 59% regarding the full course load can decide to make use of once the an effective full-big date otherwise region-go out college student. Refer to People with Permanent Handicaps to learn more.

Qualified Will set you back

Note: Candidates getting training as a result of communication otherwise learning online are not qualified to possess childcare otherwise transport can cost you, except for episodes where within the-category attendance try compulsory (we.e., laboratories, classes, assessments, etc.).

Resources

A candidate (and you may spouse or prominent-rules companion, when the applicable) is required to report every family earnings depending on Line 15000 of their past year’s Income tax Get back(s).

Guidance Offered Government

Part-go out children may be entitled to use up to $10,000 partly-Go out Canada Student loans. Part-date college students don’t have an optimum amount of weeks; not, the maximum financing restrict is actually $ten,100, leaving out interest.

Whilst in-research, college students aren’t necessary to generate monthly premiums on their area-day mortgage. Such as full-day financing, pupils are not necessary to create money up to 6 months once their period of research prevent big date or the date it get-off post-second knowledge.

The brand new Canada College student Give getting Region-day Training (CSG-PT) will bring as much as a maximum of $step three,600 for each instructional seasons. It provides reasonable-income area-day people with non-repayable financial help to simply help protection the costs of the degree. Brand new CSG-PT exists each season of article-secondary degree, given the newest pupil continues to meet up with the qualification standards.

Part-day students of lower-income family members that have doing a couple of children less than age -twenty two educational season) and area-go out people that have around three or even more children -twenty-two educational season).

People cannot located so it give when your Canada Student Give for Part-Go out Education suits their assessed need. Also, the degree of so it offer does not go beyond the fresh new student’s examined you desire.

Note: Exceptions can be produced for students that have dependents several many years of age or more mature that a permanent disability (college students need to fill in proof new dependent’s long lasting disability from the version of a healthcare certificate or papers confirming bill from federal or provincial disability assistance).

Part-go out youngsters which have long lasting disabilities may be entitled to discover $4,one hundred thousand each academic season (toward 2021-twenty two academic seasons). The new Verification regarding Eligibility Mode must prove the newest student’s long lasting impairment. The latest CSG-PD can be obtained for every single season from blog post-additional knowledge, given the college student continues to meet the qualification conditions.

Part-time children that have long lasting handicaps tends to be eligible to discover upwards to help you $20,100000 for every educational 12 months to have training-associated costs associated with brand new student’s long lasting handicap (we.elizabeth., costs for choosing teachers, note-takers or interpreters, braille-relevant costs or technical aids). To apply for the newest CSG-PDSE, StudentAidNL requires the student and you can a professional specialized during the college or university to do the applying to have Grant to possess Attributes and you can Gadgets to own Students which have Long lasting Disabilities.

Guidance Offered Provincial

It Provincial Region-Big date Incentive Offer brings help lessen the financial load encountered of the students hoping to keep its training into the a part-big date basis. The applying complements investment readily available under the current Canada Pupil Monetary Guidelines System getting Region-Big date Studies.

The Provincial Part-Time Added bonus Offer is equivalent to the level of analyzed Canada Education loan in order to a total of $five hundred for each and every semester (so you can a total of $1,one hundred thousand each instructional seasons). StudentAidNL instantly analyzes people for this grant with the app to own brand new Canada Beginner Financial assistance System to possess Part-time Degree.

New Provincial Give to own Higher You would like Children which have Permanent Handicaps covers the training-relevant costs associated with the newest student’s long lasting handicap that exceed the new limitation available from the Canada Pupil Offer getting Attributes and you may Equipment (CSG-PDSE). Whenever students can be applied with the CSG-PDSE, he’s instantly considered because of it give. Pick Permanent Handicap for further facts.

Searching Your Financing

To possess information on receiving money in depth over, delight see Choosing The Financing. Depending on the sorts of eligible capital, students must pursue one or more process.